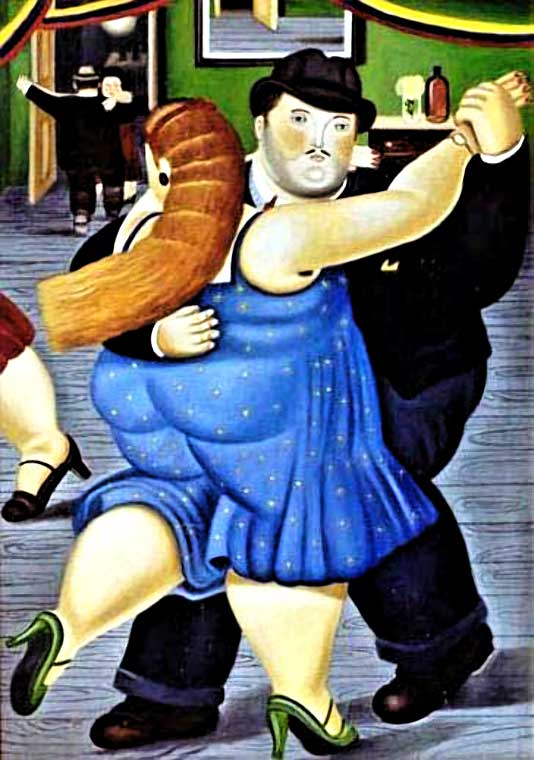

Insurance tends to be very boring, until there is a claim filed, and then it becomes real. Harvey and Irma came through the door of the dance hall and everyone knew they arrived. The bean counters (actuaries) that sit in the cubicles of the carrier home offices are now starting to see the early possible impact on the "slam dance" that was brought on by Harvey and Irma. They contemplate reinsurance costs. Reinsurers are the folks that insure the insurance companies. Wrap your head around that for minute. They are the "big wallets" that can set trends in rate, based on their own actuarial department fears of loss. The ripple effect of these two major storms may take awhile to measure. Reinsurance gets negotiated once a year by each carrier.

Harvey is already exceeding 180 billion in losses and Irma is trending at 55 billion so far. Both of these losses have a major flood component to them that is being underwritten mainly by the federal government. This doesn't necessarily mean that we are off the hook yet. When these catastrophe losses occur, actuaries skip lunch and work late into the evening to make sure they get their numbers right.

It's too soon to tell what kind of total impact will occur, but I would expect some carriers to look at coastal areas with a microscope in the future. Some big players in the marketplace like State Farm, who had 53,000 claims filed at the start of the loss, could be impacted by the terrible sound that Harvey and Irma are dancing to in September.

The National Flood Insurance Program was already $24 billion in debt before Harvey and Irma, and the program needs to be reauthorized in September. There have been talks about privatizing the program, but it seems almost inevitable that rates will have to go up to cover losses.

After Sandy in 2012, which caused an estimated $73 billion in damage, insurance rates across the board rose between 3 percent and 7 percent, but flood insurance rose 25 percent or more.

Please check your flood policies. If you don't have a policy, get one. A large number of folks in Houston that didn't think they would ever see water rise that high, are now revealing they had no coverage.

Stay safe!

Jeff Rosenkilde, CIC

Jeff Rosenkilde, Sr. CIC is a Certified Insurance Counselor with over thirty years of experience insuring small businesses in the Mid – Atlantic Area. His firm, Rosenkilde and Associates, insures over 4,000 policy holders and specializes in business insurance and risk transfer.